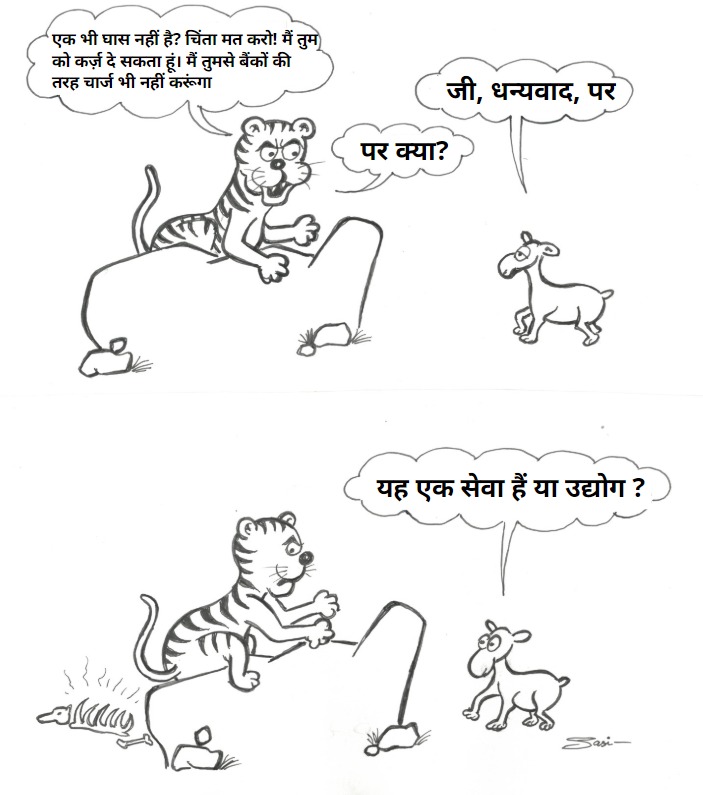

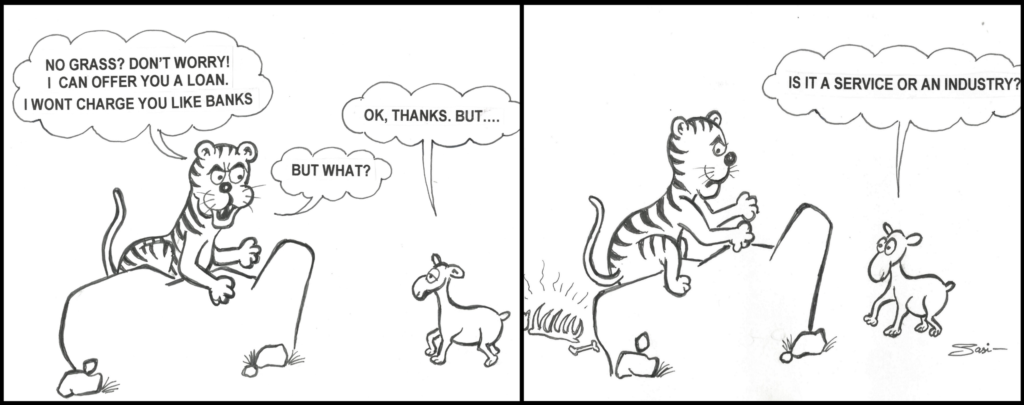

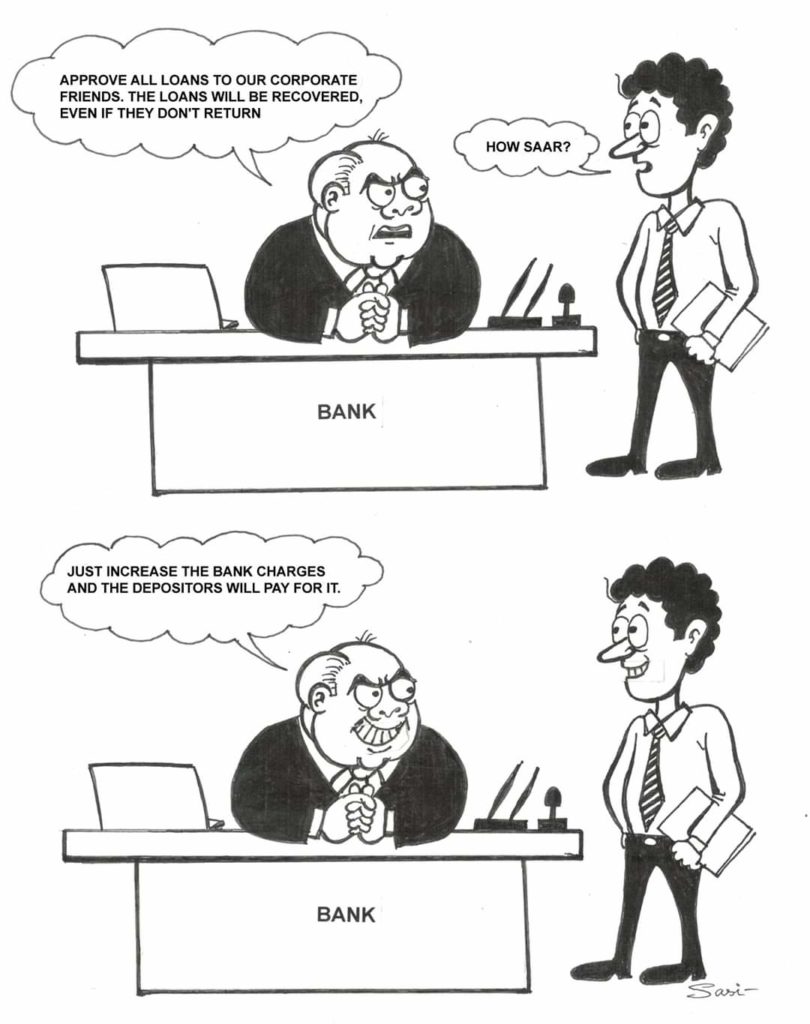

The massive bank charges introduced in past few years have greatly affected the financial state of marginalised working class. This was better understood when the team of FanIndia has talked to some people of working class who belong to the indigent sections of the society such as farmers, construction labours,…