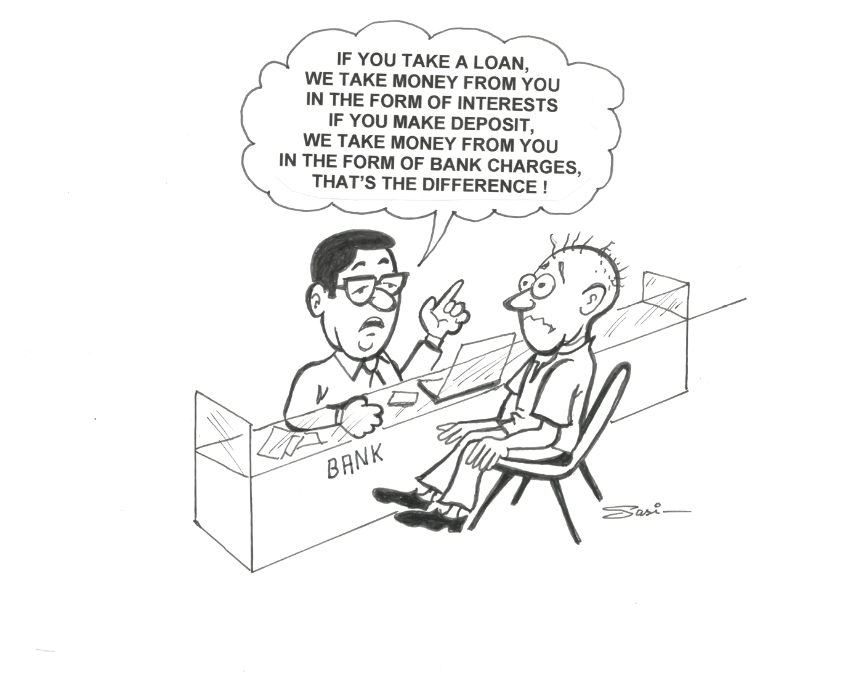

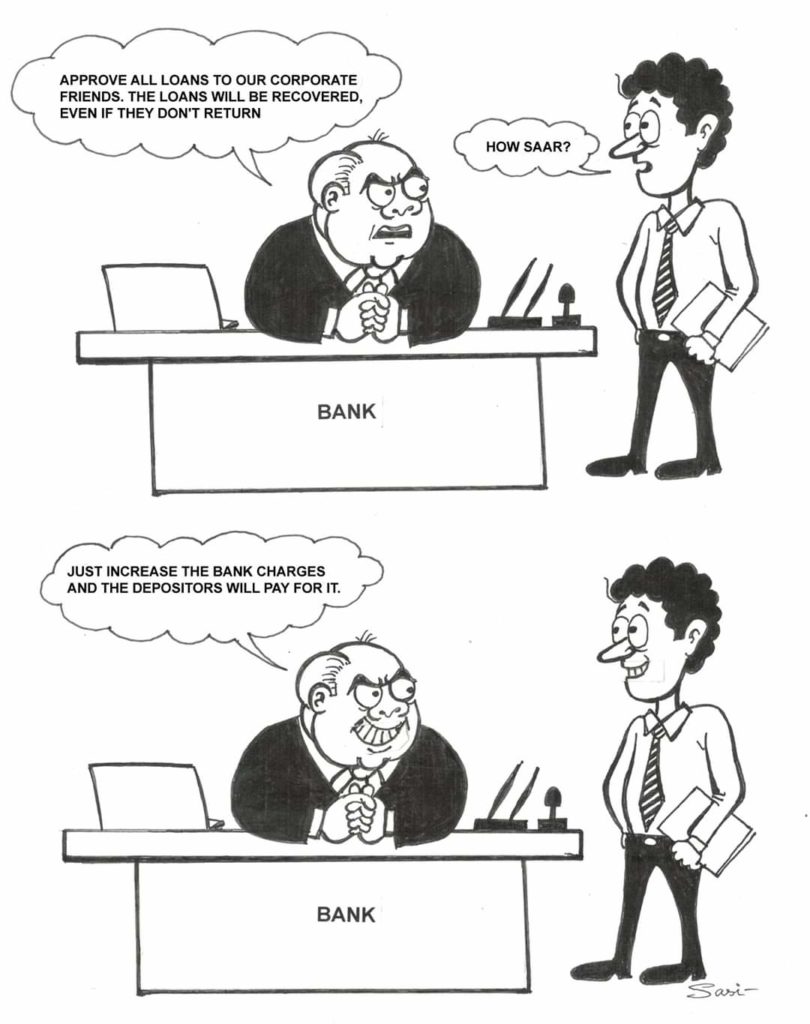

Due to nationwide lockdown started from 24th March, 2020 amid of corona pandemic, Finance Minister Ms. Nirmala Sitaraman announced waive off of charges for not maintaining Monthly Minimum Balance and for ATM transactions for 3 months, i.e. April-May-June as a part of economic relief measure. But despite this announcement,…