All the banks, especially the public sector banks have a moral obligation and social responsibility of promoting financial inclusion and social welfare. The banks run on the deposits and when a bank sinks, depositors lose their savings. Therefore, deposit holders have a right to the common and basic banking services for free of cost. If banks look at it only from the commercial angle, then they will not achieve the goal of serving common people. Ironically, now banks have begun foisting numerous fees on customers for very basic services. It starts with the balance amount becoming lower than the require limit, to charges whenever one swipes the debit card or even withdrawing more than a specified number of times at the ATM. Every transaction from bank account leads to fees.

Here are some details to understand that for which services and how much amount the banks are deducting as a charge from saving account holders:

Minimum Balance: Almost every bank asks its saving account holders to maintain a minimum amount of balance, as monthly or quarterly average balance. The penalty on failing to maintain the minimum balance varies from bank to bank. SBI deducts Rs 20 per monthwhereas private banks deduct as much as Rs 650 per month.

Cash Deposit Withdrawal: Saving account holders are not allowed to have unlimited cash withdrawals and deposits from banks, not even from their home branch. Banks are allowing only a handful of free transactions every month from bank branches. Upon exceeding the allowed number of free transactions, mostly 3 to 5 every month, customers need to pay charges anywhere between Rs 50 to Rs 150 depending upon the bank.

ATM, debit card and cheques: There was no restriction on number of financial and non-financial transactions done through ATM. Later, RBI put a limit on number of free transactions, 5 from own bank’s ATMs and 5 from other bank’s (3 in metro cities) ATMs. Now banks are charging between Rs 8 to Rs 20 depending upon the type of transaction such as balance inquiry, mini statement and cash withdrawal.

Additionally, from Rs 100 to Rs 500 are charged as annual fee on debit cards. Replacement or issuance of new debit card costs Rs 100-250. Banks also charge every time a customer resets the ATM PIN.

SMS Alerts of Banking Transactions: Banks are also charging for the text messages that customers receive as and when there is a transaction. A service which started to enhance the security and alert the customers of any unlawful or fraud transaction, has also become a way of extracting money from depositors. Banks are charging Rs 15-20 per month, quarterly in some cases for the text message service.

Documentation: Banks are even charging their customers when they update their KYC documents, for issuance of duplicate passbook and account statements.

Apart from these charges, there are many other charges that banks levy on services. It is clear that there is not a single service left which banks provide without any charge. Every service comes at a cost for poor and common depositors. In fact,many customers are not even aware about the deduction of these bank charges from their saving accounts. They are completely unaware about the quantum of amount and the kind of services for which banks deduct their money. Bank charges are making the condition of poor worse and vulnerable by making them more financially weaker.

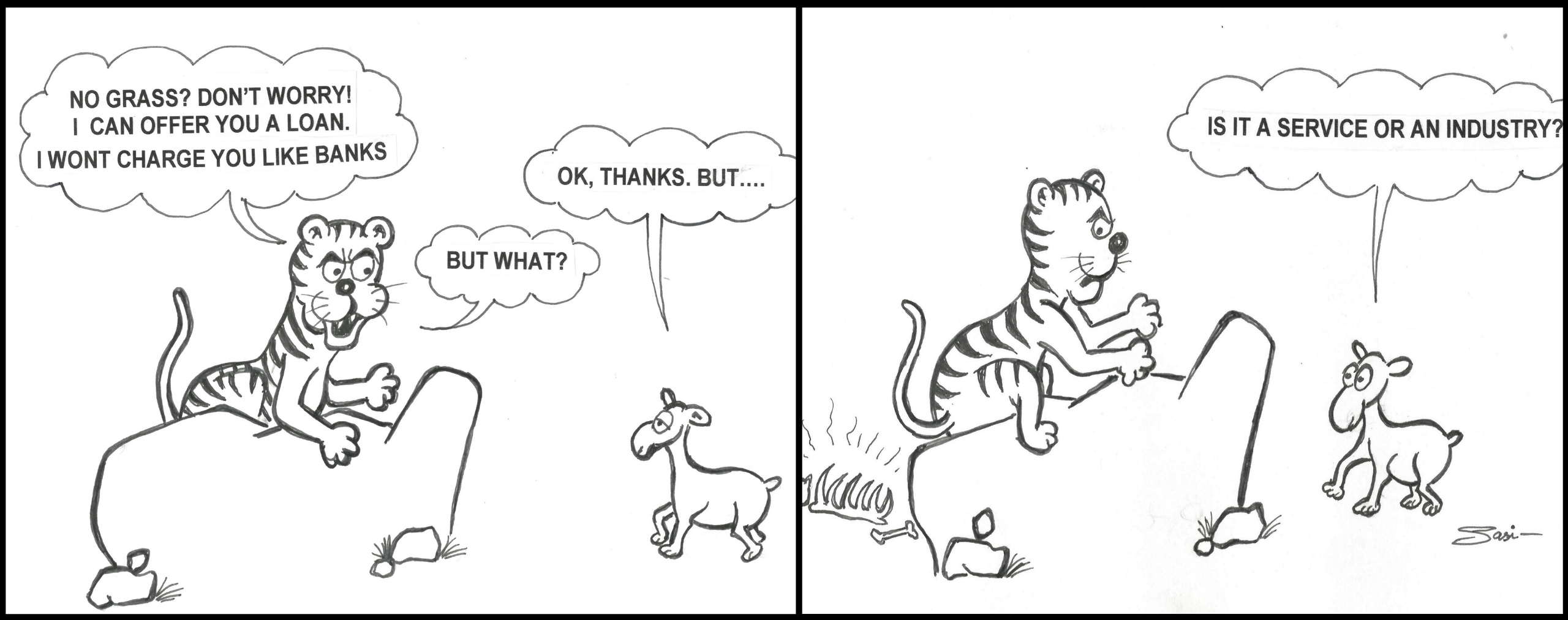

It is evident from these charges against every banking service that bank don’t exist anymore for the common people. They have become business firms like any other business industry who are letting the corporates go free when they don’t pay back their loans but penalise the common people without whom deposits they won’t survive.

Through the ‘No Bank Charges’ campaign, we demand that RBI MUST ask banks to remove all the charges levied on savings accounts. RBI should set guidelines for the banks and ensure that the banks do not exploit depositors.

The article published in CounterCurrents can be accessed here.