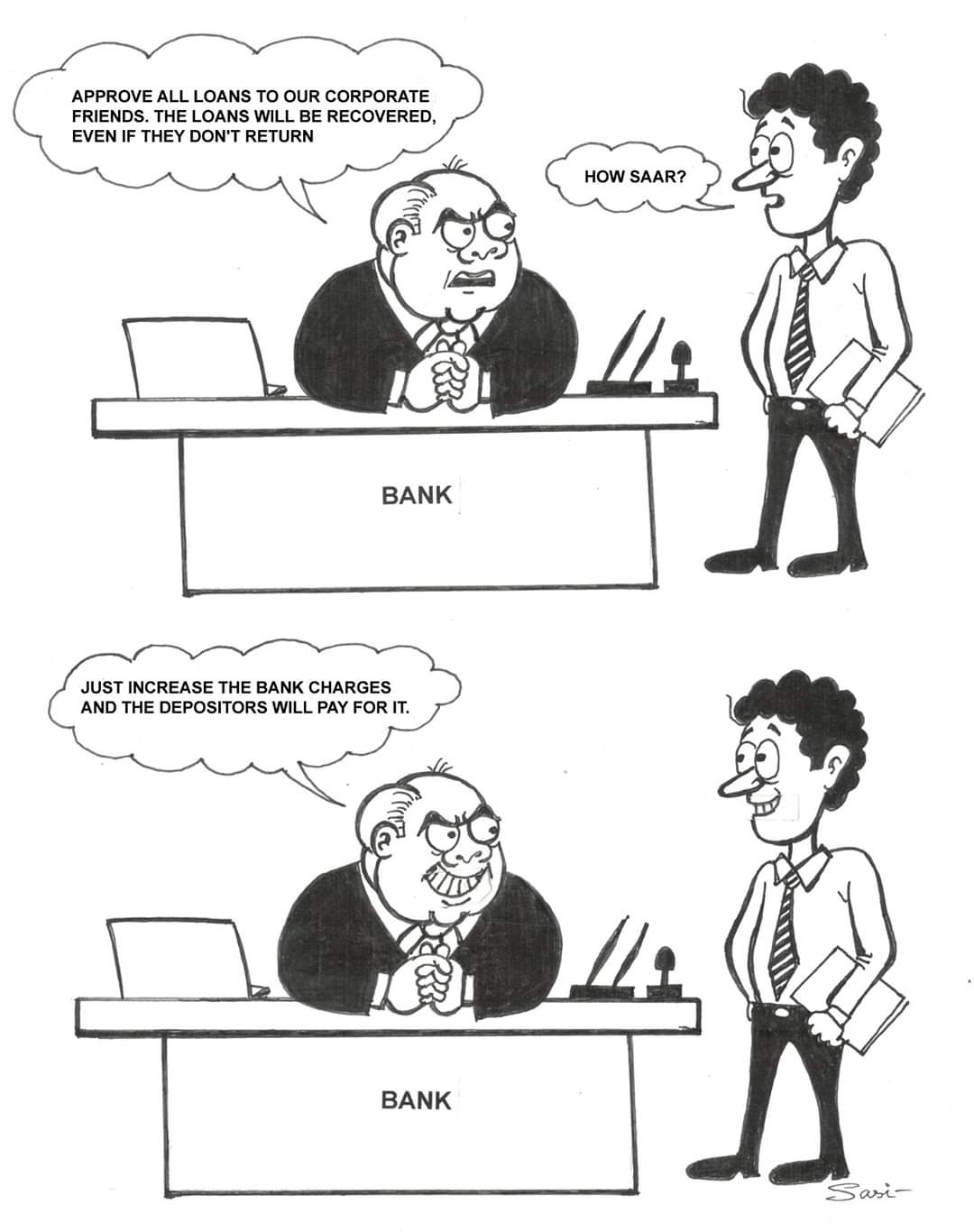

The primary objective of nationalization of banks was to reach out to each and every last person of our society. The purpose was to provide credit facilities to poor and marginalized sections and free them from the clutches of moneylenders. Banks were to provide credit to small and medium businesses. But with the abolition of development finance banks (DFIs), commercial banks also started lending to big corporate houses and industrialists for large developmental projects. The practices of aggressive lending without following proper due diligence, have led to an explosion in non-performing assets (commonly called bad loans). Loans were sanctioned even to unviable projects with no certainty of payments within specified time periods. Additionally, there have also been cases of willful defaulters, where loans were not repaid back deliberately despite having the resources to pay.

All these bad practices have increased the non-performing assets (NPAs) from Rs 2.6 lakh crore in 2014 to Rs 9.58 lakh crore as of December, 2019 (NPAs are those loans which were not paid back to the banks within the stipulated time). More than 80% of these non-performing assets belong to corporates. To cover the loss of bad loans (or NPAs) banks are required to put aside provisions from their own profit (up to 100% if not recovered at all).

Banks have failed miserably in recovering these loans from the corporates. Banks have written off NPAs worth Rs 6.6 lakh crore since 2014 including a whopping Rs 2.37 lakh crore in 2018-19 alone. Insolvency and Bankruptcy Code was introduced in 2016, to recover the loans from companies and banks are taking huge hair-cuts in the resolution processes. Companies are sold at throwaway prices and banks are taking cuts as high as in 90% in some cases.

To compensate the loss from NPAs, banks introduced various fees, penalties and charges for depositors. These charges have increased manifold in the recent years. Depositors are being asked to pay for each and every service they avail from banks. In previous five years, more than Rs 15,000 crore has been collected by scheduled commercial banks as penalty for not maintaining minimum balance and Rs 4200 crore have been collected by public sector banks for having ATM transactions. And these are only two charges out of many charges levied by banks for banking services.

All these irresponsible and incautious activities of the banks show that banks have shifted their focus from mass retail banking to profit-oriented corporate banking. They are favouring corporate firms and putting the burden on common people. It has become a completely unfair and unjust system for the small depositors.

Through the ‘No Bank Charges’ campaign, we appeal to the Government, Reserve Bank of India and Banks to strengthen their recovery mechanisms and take criminal action against wilful defaulters. Banks must also put a check on aggressive lending practices, to reduce non-performing assets. This socialization of loss must not happen through the transfer of loss from corporate loans to depositors in the form of bank charges for which they are not responsible at all.

This article published in CounterCurrents can be accessed here.