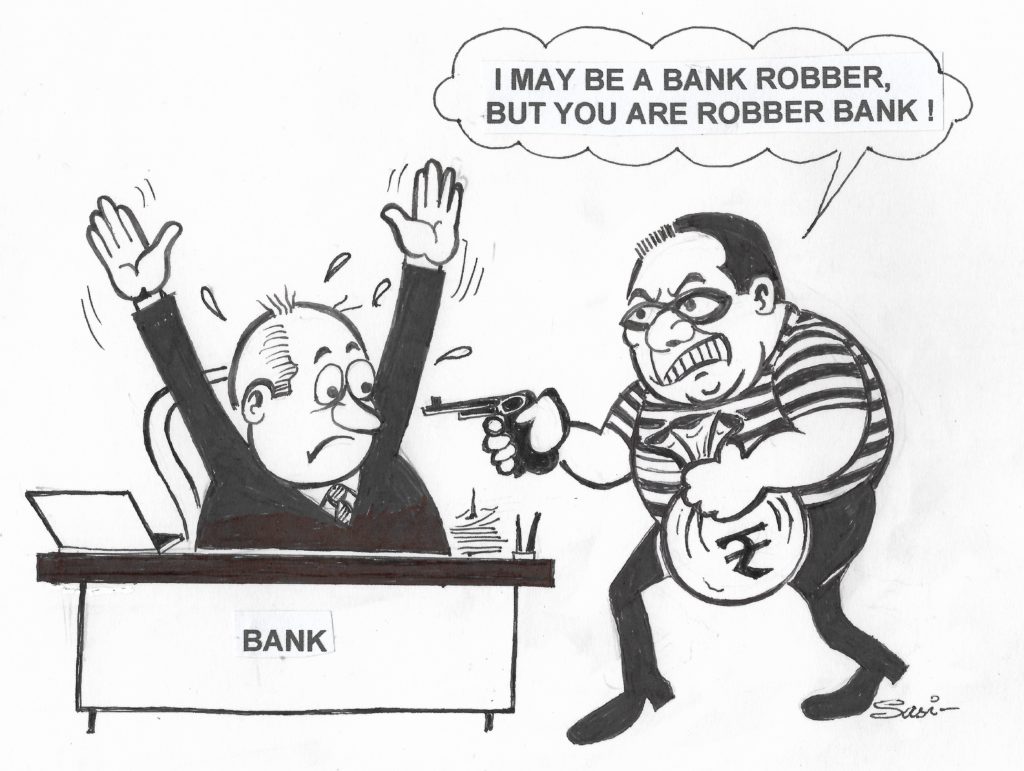

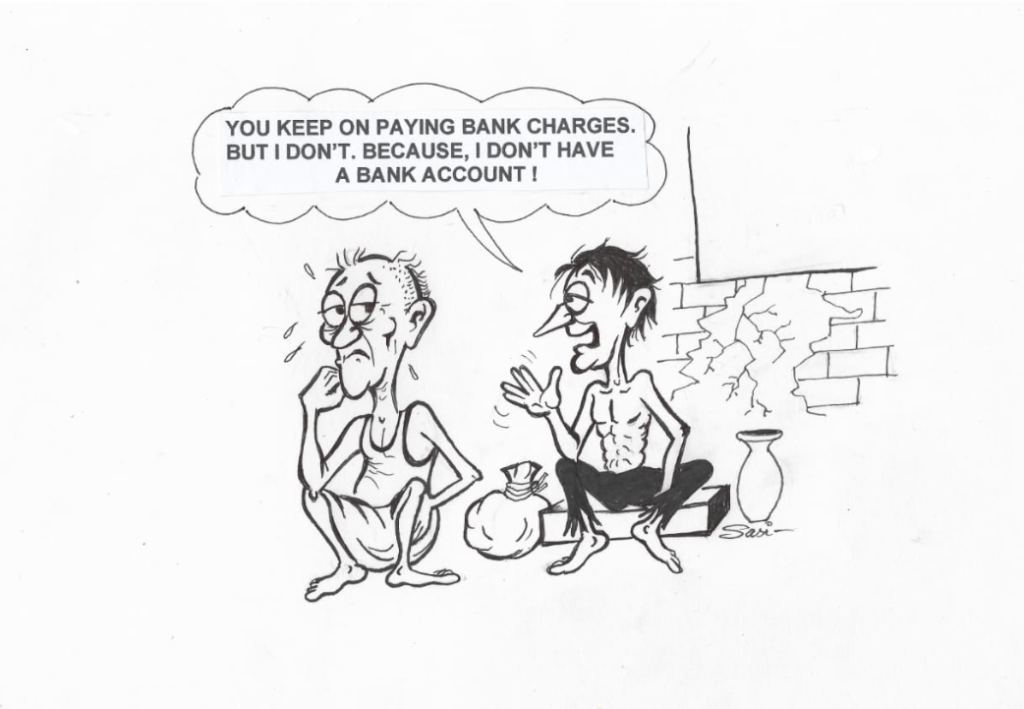

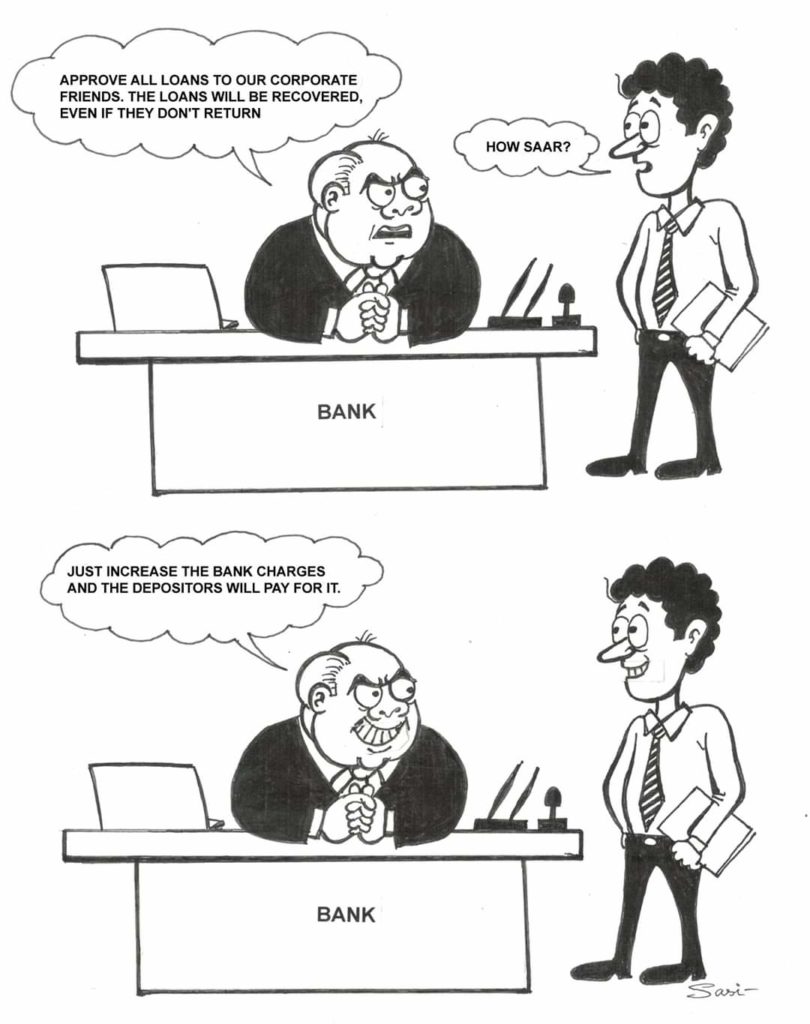

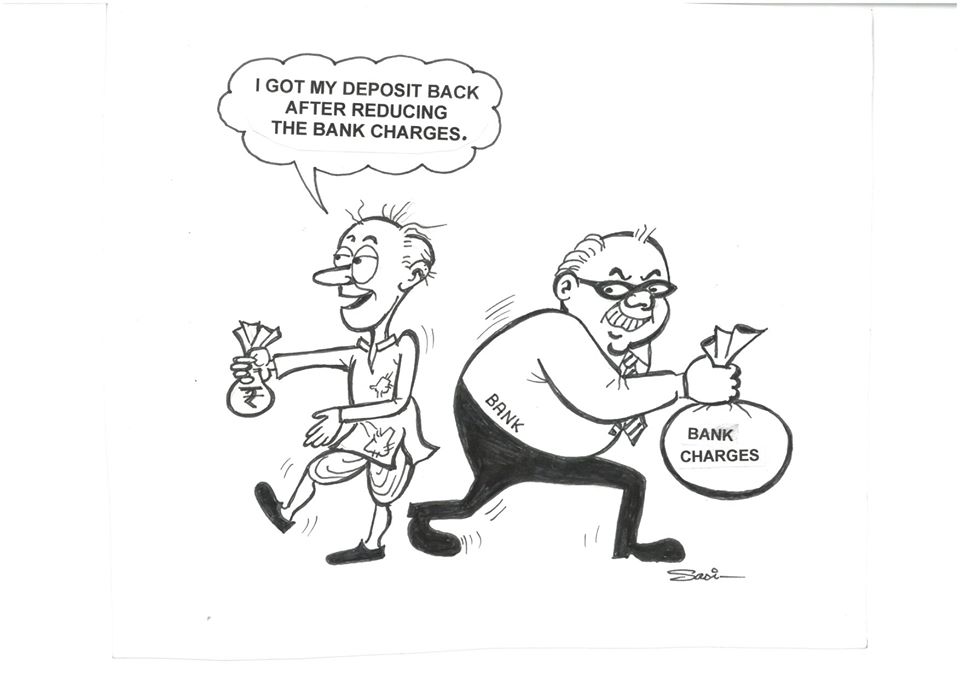

July 11, 2020, Delhi: Financial Accountability Network India condemns the banks for resuming the bank charges which were withheld for three months by Finance Minister. While all the banks resumed the ATM charges and penalty for not maintaining the minimum balance from the month of July, Bank of Maharashtra increased the…