In the last few years, banks have begun foisting hefty charges on customers on all the banking transactions. While some of the charges existed before but the new charges have been introduced on very basic everyday’s transactions.

At present most banks even have charge on maintaining minimum balance, cash deposits and withdrawals at their branches and ATM’s, balance inquiry, SMS alerts. People are charged even for failed transactions on debit cards, issuance and re-issuance of debit card, debit card annual charges, for any mobile number, address or other KYC related changes, for depositing money at cash deposit machines, ATM pin generation, ATM card replacement, cheque book etc.

Now the depositors have to pay a charge on each and every financial and non financial transactions and services as well. Now there is not a single service that we can say is offered without charging, making it extremely discriminatory for the poor and deprived sections of the society like farmers, students, daily wage labourers, street vendors etc.

Banks uses the money of small depositors to lend to borrowers and make a profit. The primary objective of these financial institutions were to do the welfare and serve the common people by making banking services easily available for them in across the country.

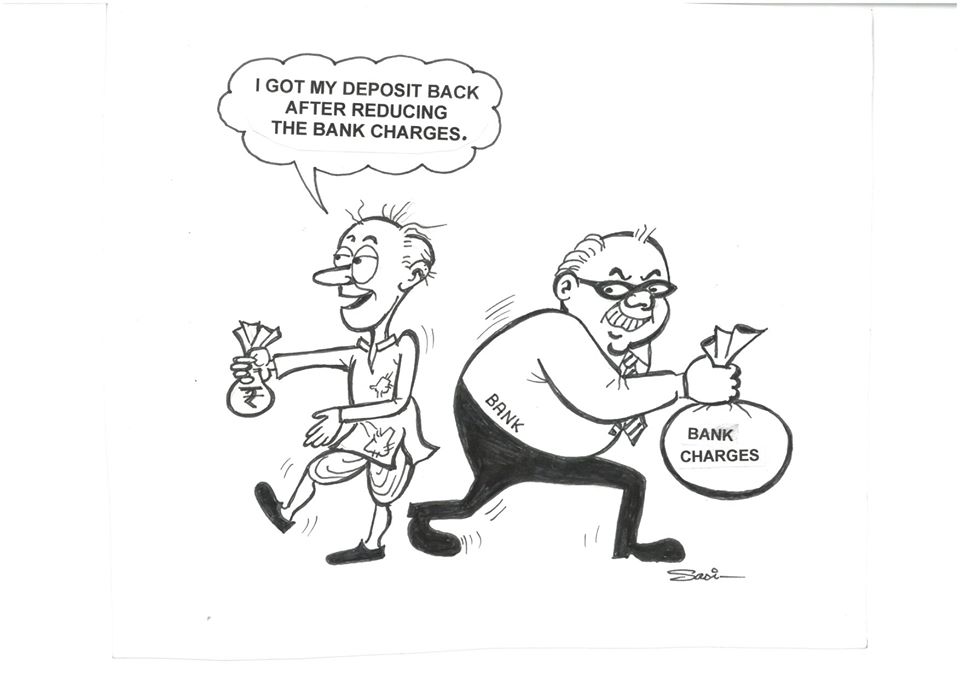

But in the last few years, banks have been deviated from its objective and started benefitting big corporate firms in the form of sanctioning huge loans to them. When they didn’t repay back, it resulted in large stressed assets and NPA’s, putting banks ultimately in massive loss and crisis. So in order to recover this loss banks have started making money by deducting charges on all the services and transactions, penalizing saving depositors in every possible way.

These charges have completely exhausted savings and sometimes even put the balance into negative, making the condition even worse for poor. Now, it seems senseless to just have a saving account in the banks who is charging for accessing their own money deposited in their own account.

This will dissuade people from being part of the banking system. In fact, many have stopped putting money in the banks after their savings were cut in the name of charges for availing services.

Through the campaign of ‘No Bank Charges’, we demand that RBI and banks must remove all the charges levied on savings accounts that are hurting the economically weaker class. We also appeal that RBI and the government should take appropriate actions to recover the loans and take strict action against wilful defaulters. The burden of these losses must not be transferred onto common people in the form of bank charges.

This article published in CounterCurrents can be accessed here.