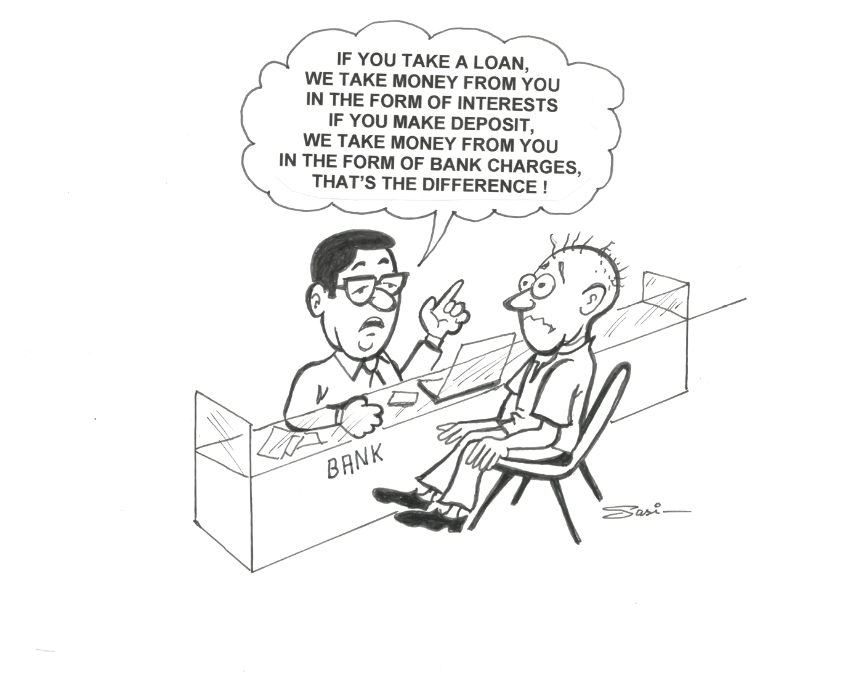

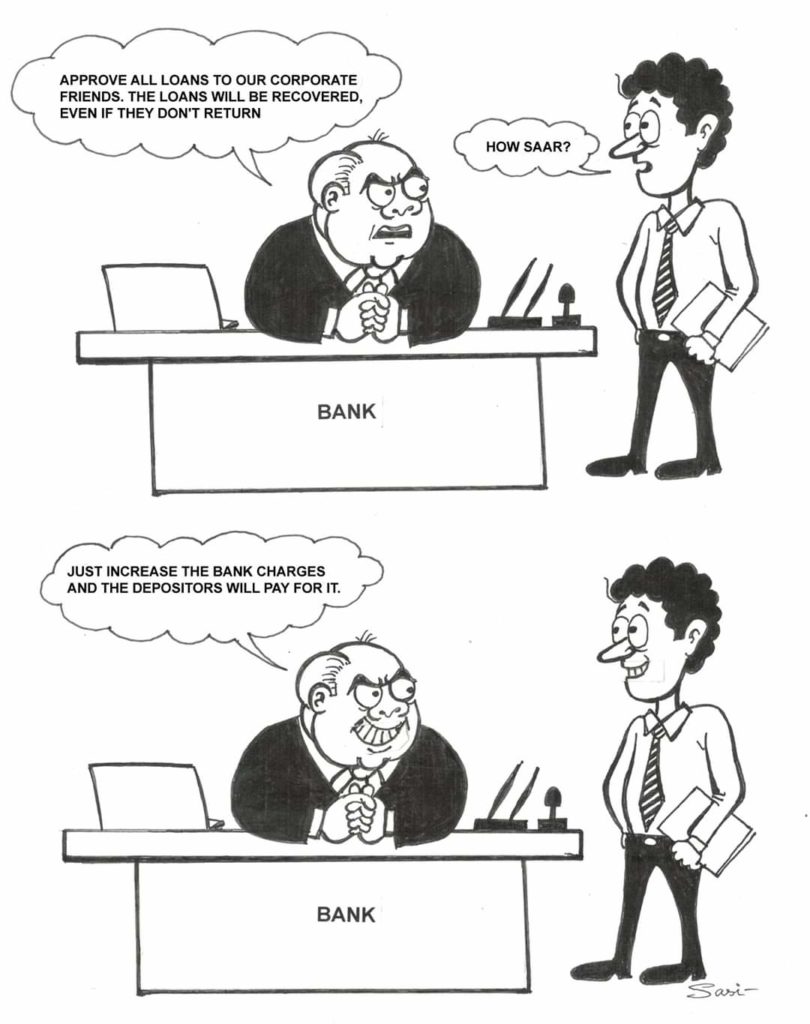

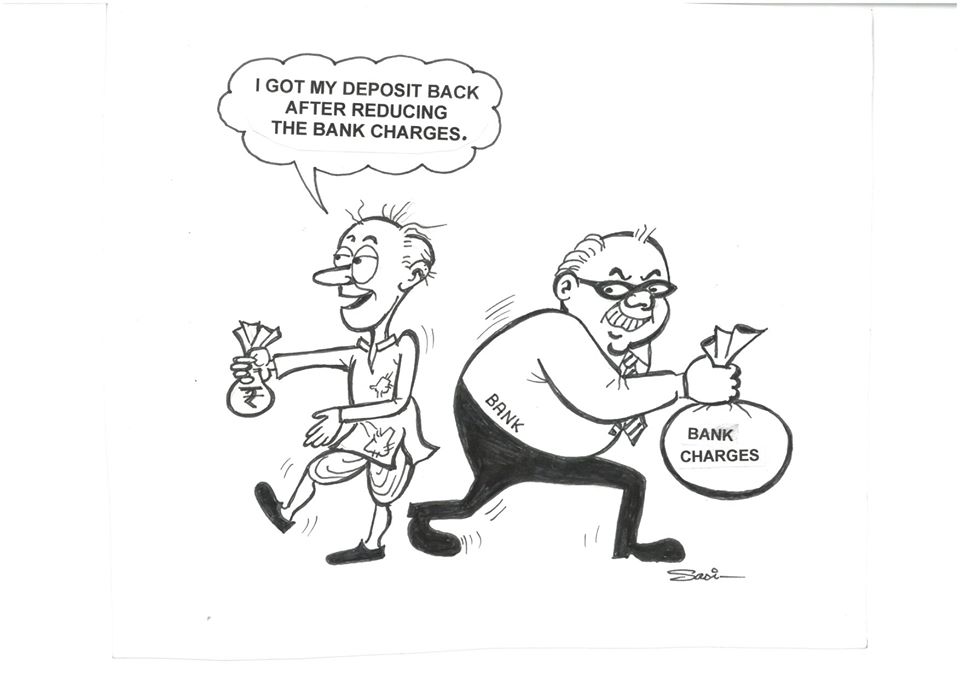

The savings of people deposited in banks form the capital of banks which banks lend to borrowers. Banks earn interest on the loans issued to borrowers. The cost of operating expenses including salaries comes from this interest on the loans issued by banks. The saving account depositors receive interest on…