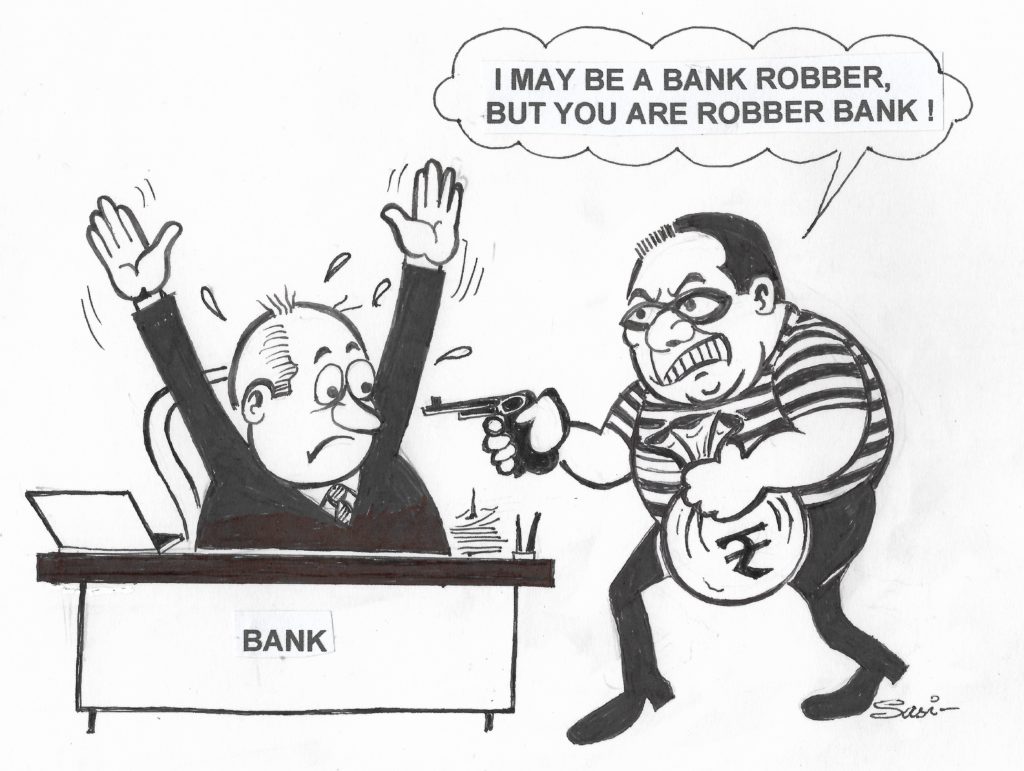

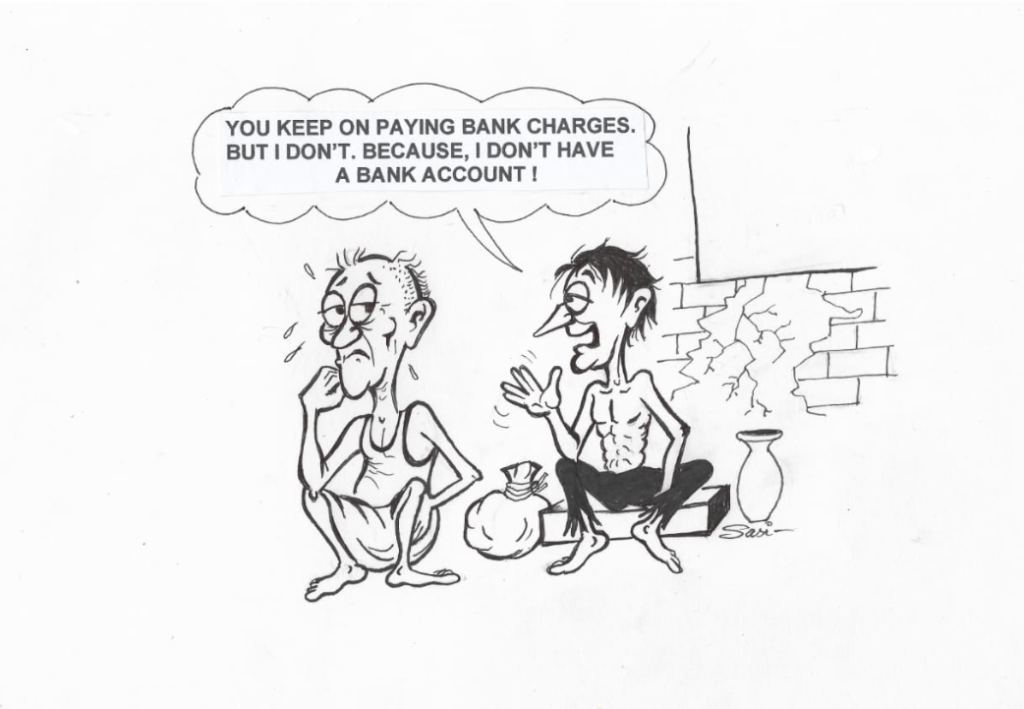

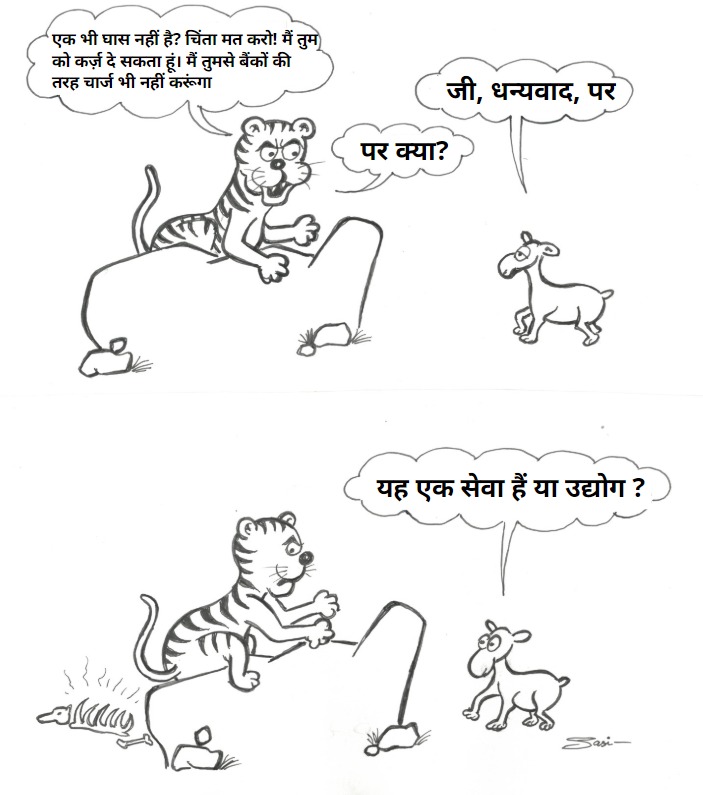

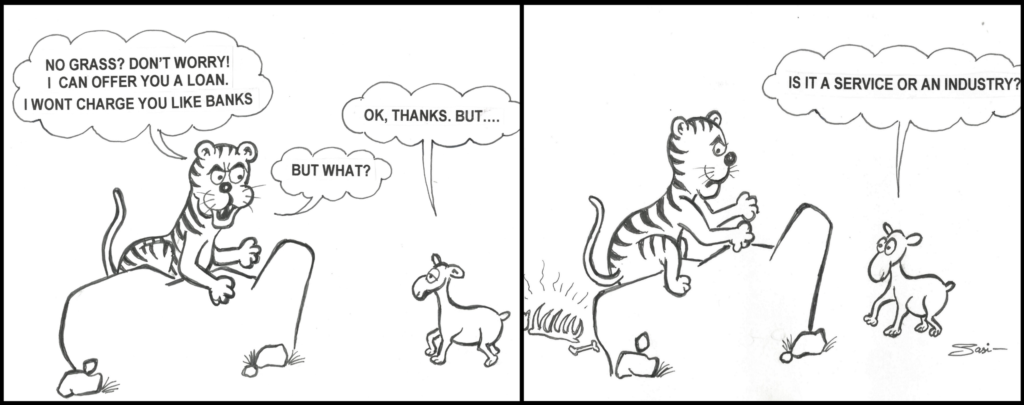

Bank Charges Should be Scrapped and Not Just Paused out of ‘Benevolence’ November 4, 2020, New Delhi: The Ministry of Finance announced yesterday that, no Public Sector Bank has increased the bank charges and will not do so in view of the COVID pandemic. The announcement came after strong backlash…